Renters Insurance in and around Newport Beach

Welcome, home & apartment renters of Newport Beach!

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

- Huntington Beach

- Costa Mesa

- Newport Beach

- Laguna Beach

- Laguna Niguel

- San Clemente

- Tustin

- Santa Ana

- Orange

- Yorba Linda

- Brea

- Las Vegas

- Phoenix

- Scottsdale

- Bend

- Los Angeles

- San Francisco

- San Luis Obispo

Home Sweet Home Starts With State Farm

Being a renter doesn't mean you are 100% carefree. You want to make sure what you own is protected in the event of some unexpected catastrophe or mishap. And you also need liability protection for friends or visitors who might stumble and fall on your property. State Farm Agent Mike Ferraro is ready to help you prepare for potential mishaps with dependable coverage for your renters insurance needs. Such personalized service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If if trouble knocks on your door, Mike Ferraro can help you submit your claim. Keep your home in a rental-sweet-rental state with State Farm!

Welcome, home & apartment renters of Newport Beach!

Rent wisely with insurance from State Farm

There's No Place Like Home

The unexpected happens. Unfortunately, the possessions in your rented apartment, such as a set of golf clubs, a coffee maker and a laptop, aren't immune to break-in or abrupt water damage. Your good neighbor, agent Mike Ferraro, is committed to helping you understand your coverage options and find the right insurance options to help keep your things protected.

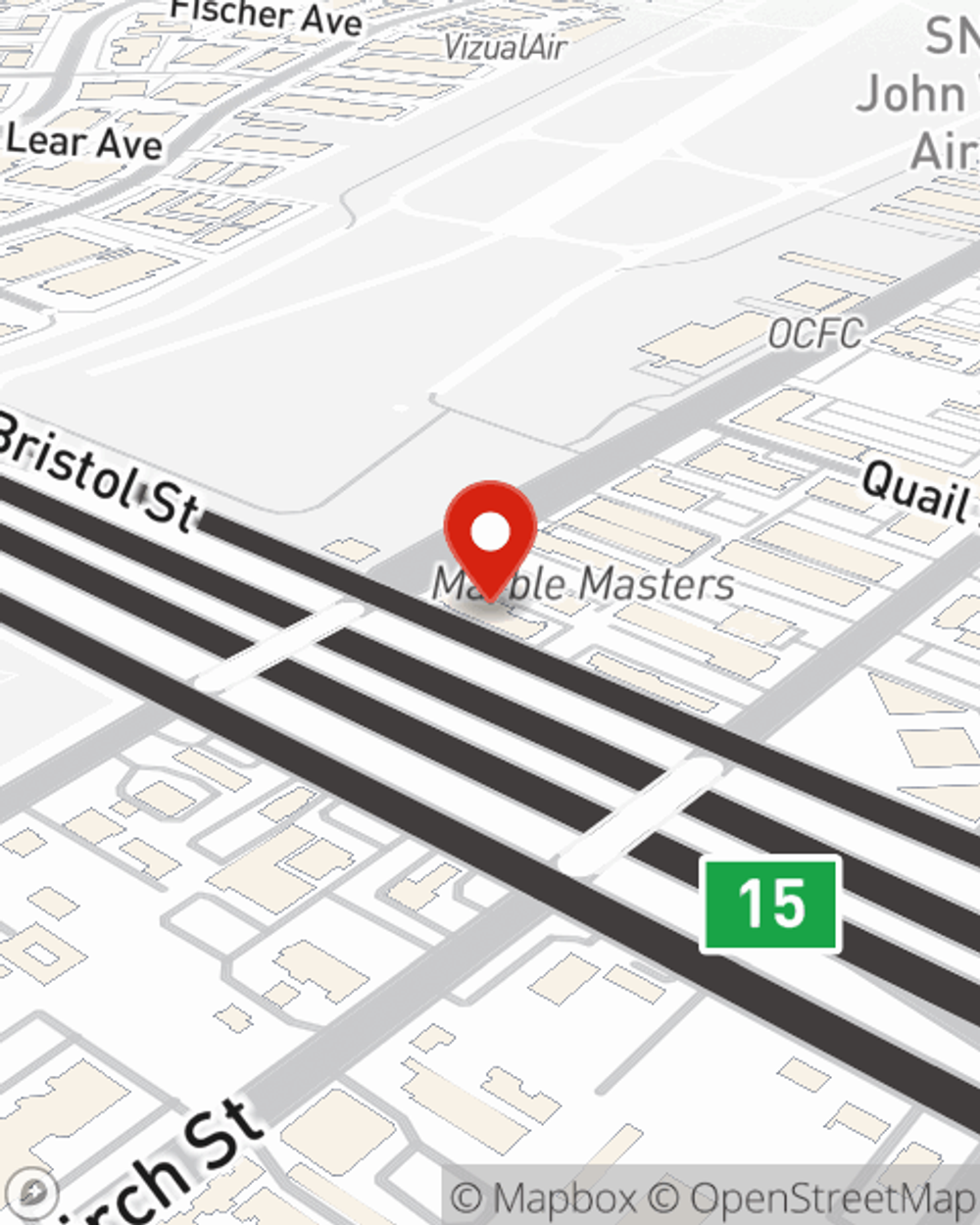

Renters of Newport Beach, State Farm is here for all your insurance needs. Visit agent Mike Ferraro's office to get started on choosing the right savings options for your rented condo unit.

Have More Questions About Renters Insurance?

Call Mike at (714) 962-6671 or visit our FAQ page.

Simple Insights®

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

Compare different types of mortgages

Compare different types of mortgages

Knowing the different types of mortgages can be confusing. Learn the different mortgage types and determine what may work best for you.

Mike Ferraro

State Farm® Insurance AgentSimple Insights®

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

Compare different types of mortgages

Compare different types of mortgages

Knowing the different types of mortgages can be confusing. Learn the different mortgage types and determine what may work best for you.