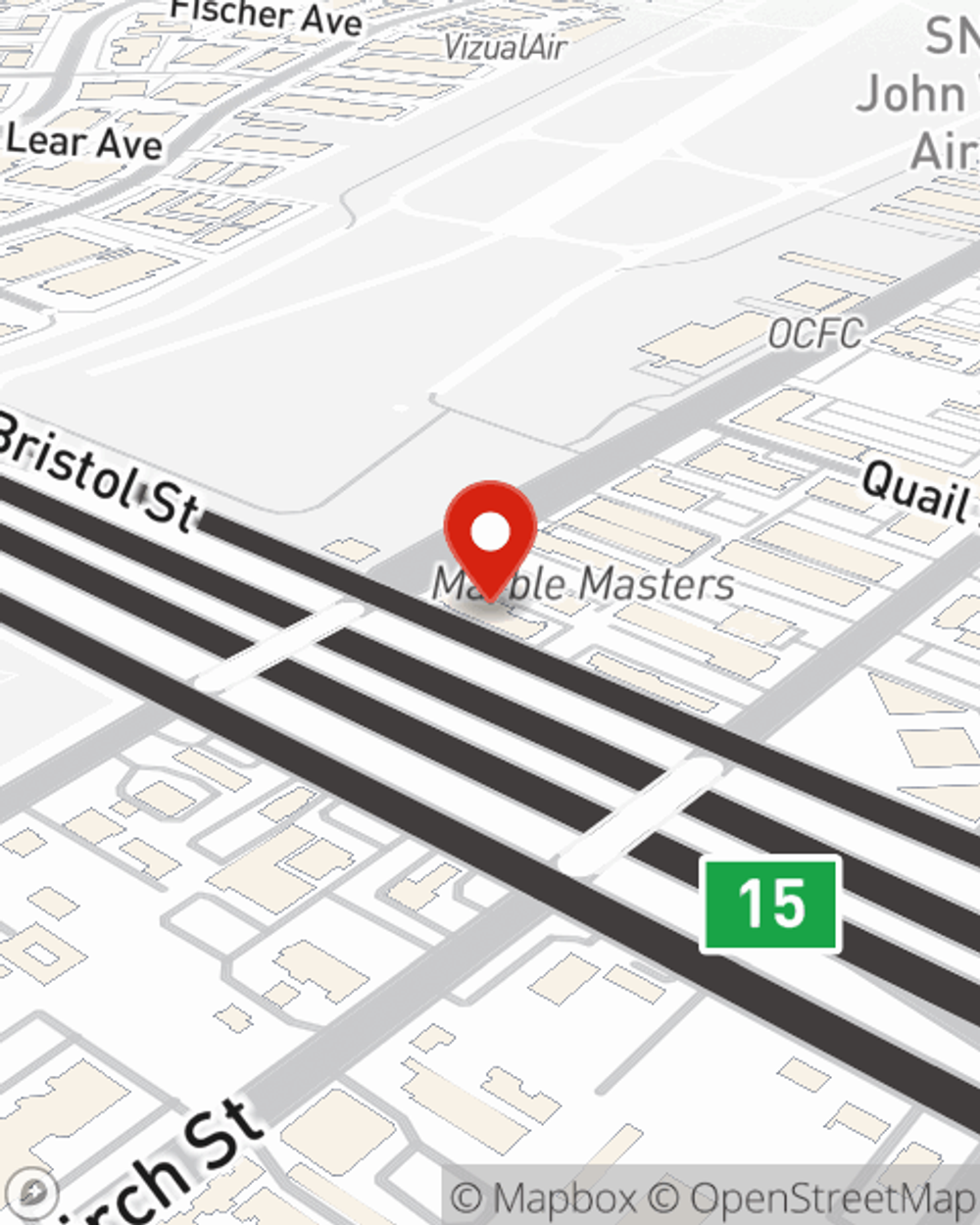

Business Insurance in and around Newport Beach

Looking for small business insurance coverage?

Cover all the bases for your small business

- Huntington Beach

- Costa Mesa

- Newport Beach

- Laguna Beach

- Laguna Niguel

- San Clemente

- Tustin

- Santa Ana

- Orange

- Yorba Linda

- Brea

- Las Vegas

- Phoenix

- Scottsdale

- Bend

- Los Angeles

- San Francisco

- San Luis Obispo

Help Protect Your Business With State Farm.

Owning a business is about more than making a profit. It’s a lifestyle and a way of life. It's a commitment to a bright future for you and for the ones you care for. Because you give every effort to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with a surety or fidelity bond, business continuity plans and errors and omissions liability.

Looking for small business insurance coverage?

Cover all the bases for your small business

Protect Your Business With State Farm

Whether you own a toy store, a farm supply store or a HVAC company, State Farm is here to help. Aside from exceptional service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Agent Mike Ferraro is here to talk through your business insurance options with you. Visit with Mike Ferraro today!

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Mike Ferraro

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.